Historical price

What is ETH?

- Ethereum is an open-source, globally decentralized computing infrastructure, executing programs referred to as smart contracts.

- Ethereum’s supply was pre-mined (72 million). Among these pre-mined ethers, 60 million were sold during an Initial Coin Offering in 2015.

- Its PoW algorithm is Ethash, an algorithm that was initially designed to prevent ASIC mining. Block time has a target of ~ 15 seconds (with a maximum block size of 1,500,000 gas). Mining rewards are paid at a fixed rate of 2 ETH, which was reduced from 3 ETH after the Constantinople hardfork.

- Ethereum is (quasi) Turing-complete, but every transaction requires gas, whose price fluctuates based on real-time bandwidth use. As a result, transaction fees are a function of storage needs, bandwidth use, and computational complexity. Gas is used to prevent infinite execution of programs; it introduces an execution cap equal to the maximum fees set for a transaction.

- Notwithstanding the lack of details on the implementation of the programmed PoS architecture in the original whitepaper, ETH 2.0 has become one of the most critical, anticipated, and controversial topics in the Ethereum community. Its PoS transition was delayed several times, with subsequent forks to postpone the ignition of the difficulty bomb.

Technology (Key Features)

Ethereum is the first digital asset to incorporate a platform with smart contract capability. It comprises the following elements, which are essential to understanding the network and its many applications.

Ether (ETH)

Gas in the context of Ethereum is a unit and a measurement for the computing power that is needed to execute certain operations in the EVM. This computing power is provided by the miners in the system, and since they use energy to produce it, they are rewarded with gas. Of course, the more energy is required for the execution of an operation (for example, a transaction or a smart contract), the more gas is needed.

It is important to point out that in reality, gas does not exist. In other words, it is not possible to own gas, and gas is not a type of token. The value of each unit of gas is expressed in ether (ETH).

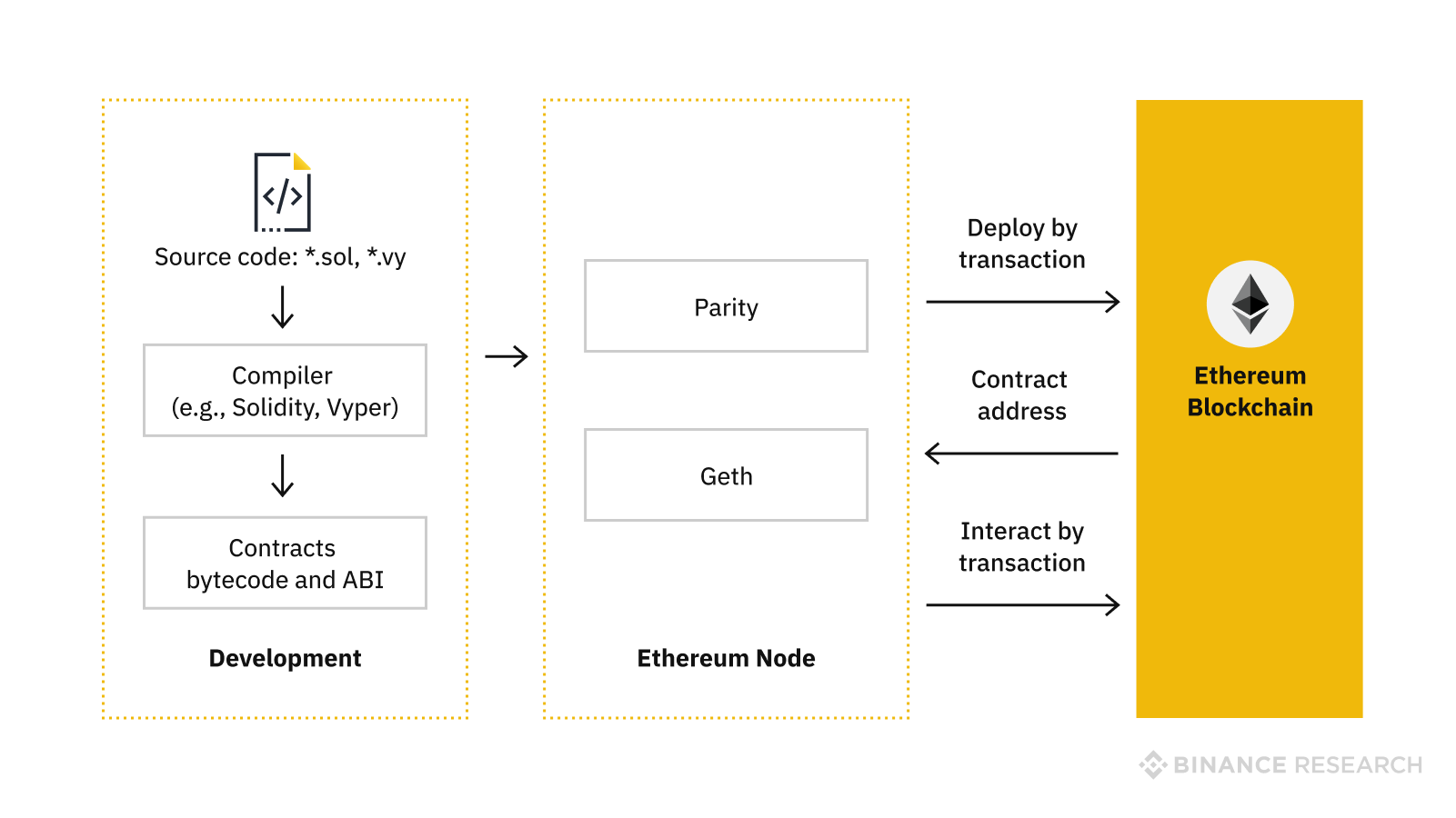

Smart Contracts

Smart contracts are applications that run on the Ethereum Virtual Machine. This is a decentralized “world computer” where the computing power is provided by all those Ethereum nodes. Any nodes providing computing power are paid for that resource in Ether tokens.

Smart contracts can be used for many different things. Developers can create smart contracts that provide features to other smart contracts, similar to how software libraries work. Or smart contracts could simply be used as an application to store information on the Ethereum blockchain.

To actually execute smart contract code, someone has to send enough Ether as a transaction fee—how much depends on the computing resources required. This pays the Ethereum nodes for participating and providing their computing power.

Decentralized Applications (DApps)

DApps are applications, programs, or tools that utilize smart contracts built into the Ethereum network. DApps have potential use cases across many sectors, including financial services, asset management, supply chain management, identity management, and data storage encryption and transfer. Some popular DApps built on the Ethereum blockchain include MakerDAO, CryptoKitties, and IDEX. MakerDAO, in particular, is currently the largest decentralized financing (DeFi) platform.24 As a tangible application of Ethereum, it has the potential to democratize access to financial services. As of February 12, 2020, approximately 3.1 million ETH were locked up as collateral for DeFi purposes.

Decentralized Autonomous Organizations (DAOs)

Decentralized Autonomous Organizations (DAOs) are organizations that function independent of a central governing body. Unlike traditional companies where ownership is divided amongst shareholders, a DAO is owned by those who contribute tokens, who are also given voting rights. In addition, the rules of a DAO are determined by its accompanying collection of smart contracts.

Ethereum Virtual Machine (EVM)

Basically, Ethereum’s virtual machine is a medium in which it is possible to execute smart contracts. It is formed and supported by each member of the Ethereum network. This platform allows smart contracts to own and fulfil their three basic properties:

- They are deterministic: or, to always give the same results when the same parameters are set.

- Can be terminated: or, there are ways in which you can prevent entering into an endless loop. Different taxes and timers solve this issue and do not allow the loss of many resources.

- Can be isolated: it is impossible for viruses and bugs in a particular contract to influence the whole system.

Source: Binance Research, modified from the original work of Li, X., Jiang, P. et al (2018).

Although simple in its goals, Ethereum’s virtual machine is effective in reaching them and thanks to it, smart contracts can be fulfilled securely.

Mining Rewards

At inception, 72 million ETH were created and distributed to the public, the Ethereum Foundation, and developers in an initial crowdsale as specified in Figure 2. Ethereum is equipped with a disinflationary mechanism to control the rate of new ETH supply issuance, which is currently capped at an additional 16 million ETH a year. The intuition behind this was to prevent arbitrary creations of money, potentially leading to hyperinflation or manipulation.

Miners who successfully confirm a transaction and upload it to the blockchain receive block rewards for their effort, providing an incentive and attributing to the exponential increase in network usage. Block rewards began at 5 ETH, decreased to 3 ETH after the Byzantium

hard fork, and decreased to the current reward of 2 ETH after the Constantinople hard fork.27 Like Bitcoin, Ethereum miners may also be paid additional amounts of ETH to account for transaction fees.

The Investment Opportunity

-

Price history and 2nd largest market capitalization

Ethereum hit a record high of $1,432.88 (Jan 13, 2018) and ETH is the world’s second-largest cryptocurrency by market capitalization behind bitcoin, with a value of $24,4 billion, according to CoinMarketCap, the world’s most-referenced price-tracking website for crypto assets in the rapidly growing cryptocurrency space. Ethereum is up over 13,000% in 2017.

The digital coin is backed by a blockchain, much like bitcoin, but the technology is slightly different and aimed at a specific use case: smart contracts. Many see it as a cryptocurrency with a real world use because of large companies that are experimenting with the technology.

A consortium called the Enterprise Ethereum Alliance, which includes companies like Microsoft and JP Morgan, is looking to develop applications using the Ethereum blockchain.

In 2017, the crypto market saw just over $3.7 billion raised via initial coin offerings (ICO) based on ETH Smart contract, a process where a company can raise money by issuing a new digital token. Investors do not get a stake in the company, but these tokens can be traded, or may be used on a service that the issuing firm offers. Many of these ICOs are built on the ethereum protocol, which has helped the cryptocurrency gain traction.

-

Ethereum 2.0 is the new breakthrough:

Ethereum 2.0 is not a new idea in the Ethereum community. A shift in Ethereum’s underlying consensus mechanism to address the restrictions of a Proof of Work blockchain has existed since the blockchain’s genesis. Ethereum 2.0 arrives on the heels of many planned upgrades to the Ethereum mainnet following the mainnet Frontier launch in July 2015, namely:

- Homestead, March 2016

- Metropolis: Byzantium, October 2017

- Metropolis: Constantinople, February 2019

- Istanbul, December 2019

The launch of Ethereum 2.0 is especially significant compared to past upgrades because of the implementation of a Proof of Stake consensus mechanism, moving the network away from its existing Proof of Work architecture.

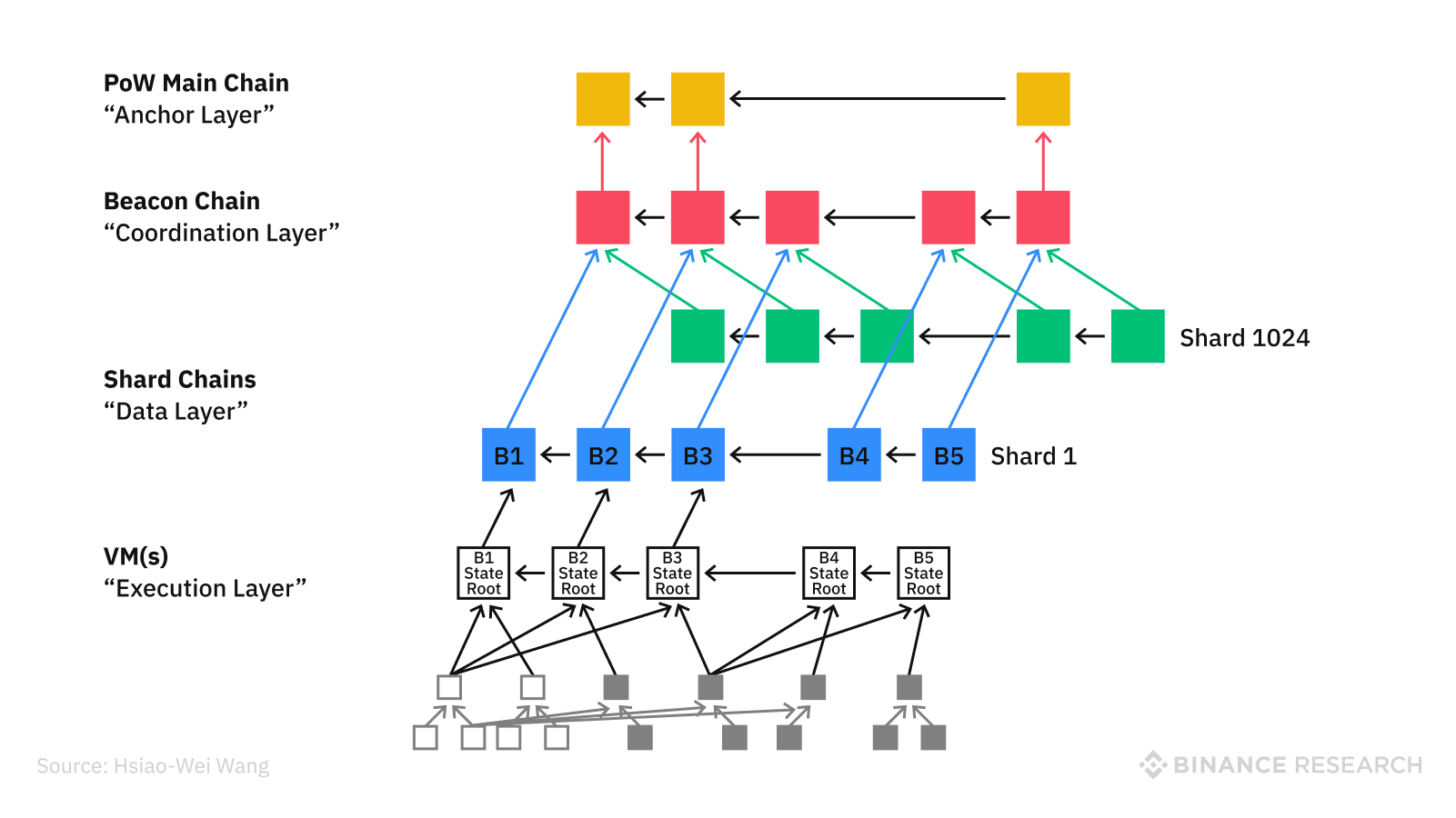

Based on existing information, Ethereum 2.0 will introduce additional elements such as:

- Beacon Chain: it acts as the “bridge” between shard chains and the main chain (the equivalent of the existing ETH 1.0 chain), which will provide staking rewards. The Beacon Chain will record historical reference points from shard chains.

- Shard Chains: thanks to the use of sharding for scalability, each shard chain is bound to operate independently (of one another) with unique states and independent histories of transactions. The main link amongst shards will be recorded on the Beacon Chain.

- eWASM: each shard is expected to have its own dedicated virtual machine “eWASM” (i.e., Ethereum-WebAssembly Machine). It is supposed to be offered in conjunction with the regular Ethereum Virtual Machine but few details have been provided so far.

“Ethereum 1.0 is a couple of people’s scrappy attempt to build the world computer; Ethereum 2.0 will actually be the world computer.” — Vitalik Buterin

“Ethereum 1.0 is a couple of people’s scrappy attempt to build the world computer; Ethereum 2.0 will actually be the world computer.” — Vitalik Buterin

If Ethereum 2.0 can solve hard problems around proof of stake and sharding, then it may be well-poised to maintain its lead as the biggest smart-contract-computing platform in cryptocurrency.

-

DeFi on Ethereum are prevailing

Decentralized Finance (DeFi) has grown to become one of the main applications of Ethereum. While the Open Finance initiative is, by nature, platform-agnostic, DeFi applications are almost exclusively being developed and used on Ethereum. One of DeFi’s cornerstones is Dai, a decentralized cryptoasset-backed stablecoin minted in the Maker ecosystem.

Souce: Theblockcrypto

Lending/borrowing protocols & platforms offer different incentives for market participants like:

- For borrowers: ability to short an asset or borrow utility (e.g., governance rights).

- For lenders: ability to insert capital to use and earn interest.

- For both: arbitrage opportunities across platforms.

Decentralized, non-custodial protocols offer several promising advantages over traditional financial products such as:

- Transparency and price efficiency as prices are subject to market demand

- Ease of access and speed when borrowing and lending capital

- Censorship resistance and immutability

As of May 31st 2019, Ethereum dominates in amount of existing applications, transaction count, and volume traded/locked on existing platforms (e.g., Maker, Compound).Around 2.5% of the ETH supply is staked on DeFi smart contracts, and this number is expected to get much bigger. This will likely give a necessary boost to the price of the coin and significantly improve the sentiment around the Ethereum protocol going forward.

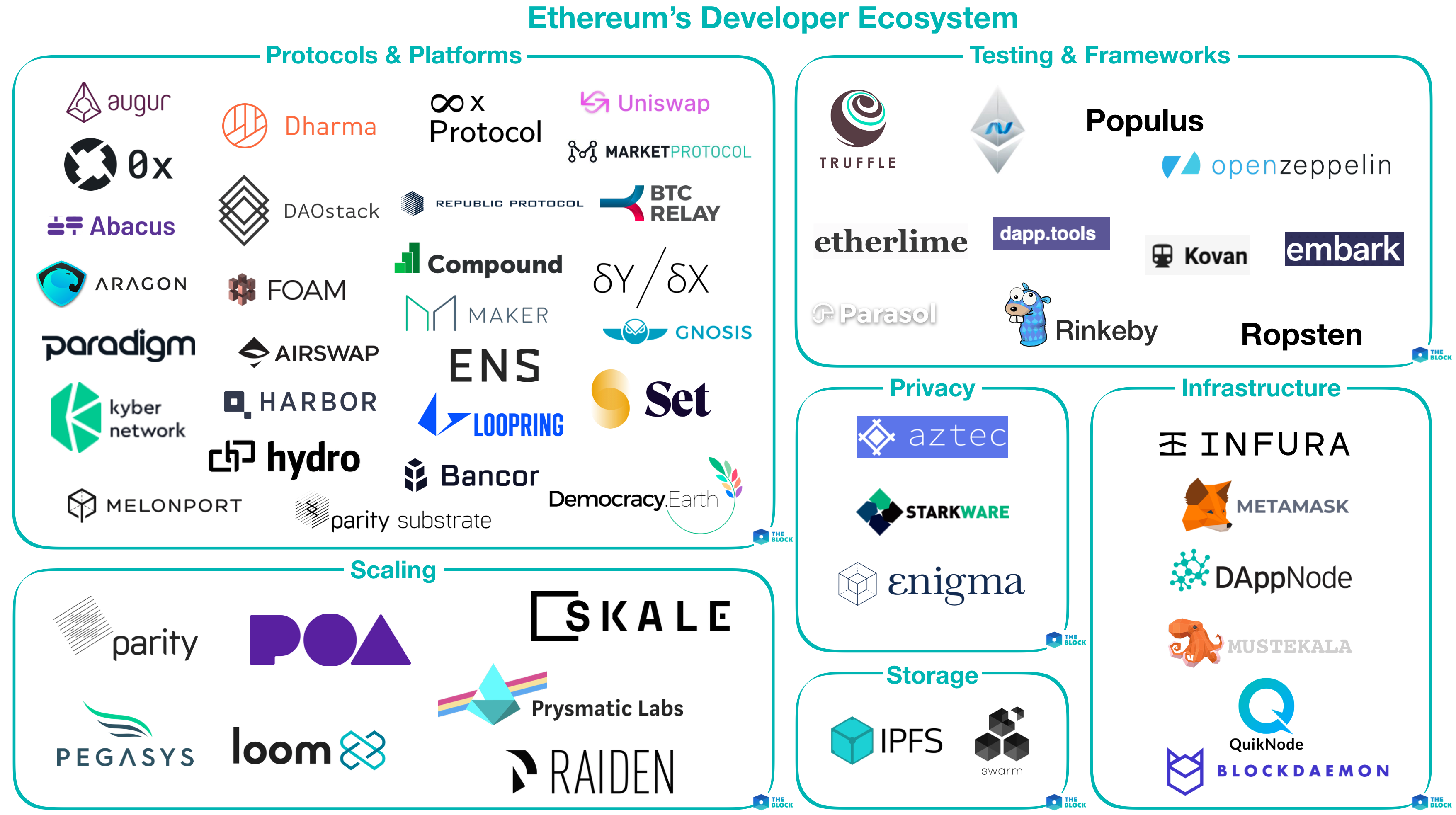

Ethereum has the largest ecosystem

Souce: Theblockcrypto

Ethereum’s ecosystem has shown good dynamics and has seen significant progress over the last year. The current infrastructure and the foundation that is building the protocol will significantly help when more users come to the protocol during the next bull cycle.

Ethereum Is Being Incorporated by Financial Institutions

Ethereum is currently the best positioned technology company for large organizations to adopt.

And this application is starting with banking institutions.

Bank of America is the first financial institution to work with the Ethereum blockchain. The company premiered an Ethereum-based application that will help customers in securing their transactions.

But both Bank of America and Microsoft want the application to be more than a security resource. It has to be a pioneer, winning the trust of the public.

This will be one of the first Ethereum-based applications that everyday consumers will interact with.

But big companies that push mass adoption will give Ethereum a leg up on other technologies.

And investors should take note that Ethereum is the only technology being incorporated by major institutions. That alone speaks to Ethereum’s long-term profitability…

Additional resources

- Binance Research (2020) – Ethereum (ETH):

https://research.binance.com/projects/ethereum

- Grayscale (2020) – An introduction of Ethereum.

https://grayscale.co/wp-content/uploads/2020/02/Grayscale-Building-Blocks-Ethereum-February-2020.pdf

- Kraken Intelligence (2020). Ethereum (ETH) – Into the Ether.

https://blog.kraken.com/wp-content/uploads/2020/02/Kraken-Intelligence-Ethereum-Asset-Review-vF-.pdf

- Trust Wallet – Ethereum Wallet

https://trustwallet.com/ethereum-wallet/