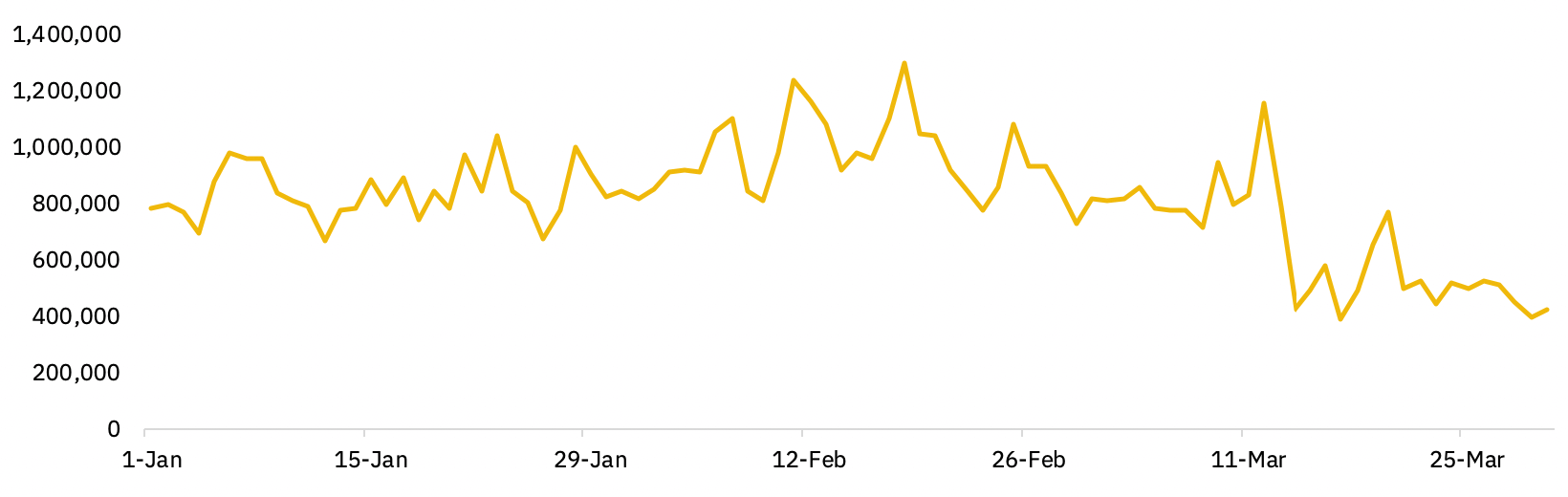

Historical Price

Introduction

Binance is a blockchain ecosystem comprised of several arms to serve the greater mission of blockchain advancement and the freedom of money. Binance Exchange is the leading global cryptocurrency exchange by trading volume, with users from over 180 countries and regions.

In 2017, it started as an exchange and has quickly become the standard for stable liquidity and low fees for traders.

As of January 2018, Binance was the largest cryptocurrency exchanges in the world in terms of trading volume.

Binance was found by Changpeng Zhao, a developer who had previously created high frequency trading software. Binance was initially based in China, but later moved out of China due China’s increasing regulation of cryptocurrency.

The meteoric growth of its user-base enabled Binance to make substantial profits during the ICO gold rush and start to expand beyond its exchange offering.

The Binance ecosystem is also comprised of Binance Labs (venture capital arm and incubator), Binance DEX (decentralized exchange feature developed on top of its native, community-driven Binance Chain blockchain), Binance Launchpad (token sale platform), Binance Academy (educational portal), Binance Research (market analysis), Binance Charity Foundation (blockchain-powered donation platform and non-profit for aiding in sustainability), Binance X (developer-focused initiative) and Trust Wallet (its official multi-coin wallet and dApps browser)

Nowaday, Binance is one of the largest cryptocurrency companies in the world, they have made important milestones when acquiring Coinmarketcap, Trust Wallet, expanding India market, leading the derivative trading volume, opening broader adoption of cryptocurrencies by fiat-to-crypto, increasing financial services (staking, savings, loans) and more…

What is BNB?

BNB powers the Binance ecosystem and is the native asset of Binance Chain. BNB is a cryptocurrency created in June 2017, launched during an ICO in July, and initially issued as an ERC-20 token. Designed to be used for fee reduction on the Binance exchange, its scope was extended over the years.

The token sale offered 100,000,000 units of BNB (50% of the total supply). The issue price was 1 ETH for 2,700 BNB or 1 BTC for 20,000 BNB (around 0.11 USD back then).

BNB powers the Binance Chain as its native chain token. For instance, it is used to pay fees on the Binance DEX, issue new tokens, send/cancel orders, and transfer assets.

In addition to its on-chain functions, BNB has multiple additional use-cases such as fee discount on multiple exchanges (e.g., Binance.com), payment asset on third-party services, and participation rights & transacting currency on Binance Launchpad.

At the core of the economics of BNB, there is a burn system leading to period reductions in its total supply (~ every three months). From its initial maximum supply of 200 million, burns will keep occurring until the supply reaches 100 million.

Binance Ecosystem

Source: Binance

Binance has become one of the greatest success stories in the crypto industry, they aiming higher, because their mission since day one is still the same: spreading the freedom of money.

This goal goes beyond main exchange platform, as it takes whole communities to spread their main principle. That’s why Binance formed several different pillars within the ecosystem to initiate change across multiple fronts. But regardless of the different areas handled by the Binance units — Exchange, Academy, Info, Labs, Launchpad, Trust Wallet, Charity — each one serves one big mission.

- Blockchain and crypto asset exchange: Delivering a secure, fast, and seamless trading experience, fueled by BNB.

- Exchange: Spot – Margin, Binance Futures, Binance Options

- Binance DEX: community-driven decentralized exchange developed on top of the Binance Chain blockchain for issuing and exchanging digital assets in a decentralized manner

- Binance Financial: Stakings – Savings – Loans – Pools

- Binance Fiat Gateways: buy-and-sell crypto platform, covering 170+ countries and regions through local payments partners and P2P platforms.

- Fiat-to-Crypto Platforms: joint ventures with global partners to buy, sell and trade crypto: Binance US, Binance Jersey, Binance Singapore, Binance Uganda, Binance Lite Australia

- Binance Cloud: end-to-end enterprise solution for launching exchanges

- Binance Fiat Gateways: buy-and-sell crypto platform, covering 170+ countries and regions through local payments partners and P2P platforms.

- Fiat-to-Crypto Platforms: joint ventures with global partners to buy, sell and trade crypto: Binance US, Binance Jersey, Binance Singapore, Binance Uganda, Binance Lite Australia

- Investment & Fundraising: Empowering blockchain entrepreneurs, projects, and communities

- Binance Labs: venture arm and incubator, investing in and supporting early-stage blockchain startups and infrastructure projects

- Binance LaunchPad: exclusive token launch platform for supporting transformative blockchain startups and entrepreneurs

- Digital asset research: Providing professional, data-driven insights and analysis

- Binance Info: market news and insights

- Binance Research: institutional-grade, data-driven insights and analysis for crypto investors

- Binance Academy: non-profit blockchain and crypto educational portal

- Binance X: developer-focused initiative to foster innovation of blockchain developers and cultivate industry growth and meaningful use cases

- Support & Adoption: Promoting transparent initiatives to build communities and expand global access

- Binance Charity: non-profit organization and first blockchain-powered donation platform dedicated to advancing transparent philanthropy

- Trust Wallet: official multi-coin wallet and dApps browser

The Investment Opportunity

-

Binance is the #1 Exchange

Binance has been the number 1 cryptocurrency exchange for a few months now in terms of both transaction volume and in the number of active users. The popularity of the exchange is immense, indicated by multiple parameters, such the the 240,000 new users within one hour

- Reported VS Adjusted Spot Volumes On Major Crypto Exchanges

Binance has built a strong reputation in the crypto community as being very supportive of the decentralization and tokenization ideology, something that is often underscored by CEO Zhao’s strong pro-cryptocurrency attitude backed by informed arguments.

-

Leading perpetual markets

Binance Futures offers perpetual futures for 24 of the most liquid digital assets, which serves as a complementary product to the existing spot pairs on Binance. The futures trading platform offers 125x max leverage for BTC contracts, which is the highest among major crypto exchanges.

In about six months, Binance Futures has risen to No. 1 spot based on 24-hour volumes and has been taking the lead in perpetual markets and BTC perpetual markets.

Chart: Performances of Binance Futures perpetual contracts in May

-

BNB – The Fuel Of The Binance Ecosystem.

BNB powers the Binance ecosystem and is the native coin of Binance Chain. BNB is a cryptocurrency created in June 2017, launched during an ICO in July, and initially issued as an ERC-20 token. Designed to be used for fee reductions on the Binance exchange, its scope was extended over the years. BNB powers the Binance Chain as its native chain token. For instance, it is used to pay fees on the Binance DEX, issue new tokens, send/cancel orders, and transfer assets.At the core of the economics of BNB, there is a burn system leading to periodic reductions of its total supply (~ every three months). From the initial maximum supply of 200 million, burns will keep occurring until the supply reaches 100 million.In addition to its on-chain functions, BNB has multiple additional use-cases, as it offers fee discounts on Binance.com, can be used as a payment asset on third-party services and entails participation rights for Binance Launchpad.

The full breakdown of organizations and projects in the BNB ecosystem

After implementing the BEP-3 standard in late 2019, Hash Time-Locked Contract functions and further mechanisms have been made available to handle inter-blockchain token pegging. This is likely to further increase the interoperability with other programmable blockchains, like Ethereum.Finally, the anticipated support of smart-contracts on the Binance Chain will likely foster additional use-cases for BNB, unlocking a new range of opportunities.

-

Binance DEX – Leading the decentralized exchange

Binance DEX: community-driven decentralized exchange developed on top of the Binance Chain blockchain for issuing and exchanging digital assets in a decentralized manner

Binance DEX based on the Peer-to-Peer (P2P) protocol and allows users to exchange crypto assets directly between each other. The main advantage of Binance DEX is the matching system. Binance DEX is created on a high powerful blockchain engine “Tendermint Core” with one-second block times, that provides the speed, which is also the same to centralized exchanges.

Chart: Sources: Binance DEX, Binance Research.

Daily volume on the Binance DEX since January 2020 (USD million)

“With the core Binance Chain technology, Binance DEX can handle the same trading volume as Binance.com is handling today. This solves the issues many other decentralized exchanges face with speed and power”. — CZ, CEO Binance

Currently, there are a total of 135 trading pairs on Binance DEX with a trading volume of over $ 800,000

-

BNB – Participate in quality projects on LaunchPad

Binance Launchpad is an exclusive token launch platform of Binance that helps transformative blockchain startups raise funds to develop products that wants to drive cryptocurrency adoption.

Earlier in January 2019, Binance announced the launch of a new project for token sales and fundraisings – Binance Launchpad. It’s a specialized airdrop and token distribution platform of cryptocurrency tokens.

Since then, Binance conducted more than 11 successful projects, some of which were created on top of the Binance Chain (BEP2-tokens).

Binance did a great job of increasing confidence and building trust as a cryptocurrency project in general, showing the high level of efficiency and interaction with the community. And thanks to Binance Launchpad, users got an easy-to-use access to other noteworthy crypto startups.

And, the only way to participate in LaunchPad is to hold BNB under the lottery mechanism.

-

BNB Burn Coin

The Binance Coin Burn is held quarterly and is a mechanism to programmatically reduce the number of BNB tokens based on the total profit (20%) in the quarter. In its whitepaper, Binance already committed to destroy exactly half of the 200 million available BNB tokens, exactly half, 100 million BNB.

The Binance Coin was issued in 2017 as part of an Initial Coin Offering to finance the exchange launch. In return for investor support, Binance is burning BNB on a quarterly basis to increase the value of the BNB token. At least in theory, the BNB price is expected to rise due to the shortage of supply.

According to Binance’s whitepaper, 40% of the total BNB supply (80 million) has been awarded to the team as a reward for the work put into building the ecosystem. These are currently being used for the coin burn.

Sources: Binance

Consistent coin burns with increasing burn percentage as per the scheduled plans indicate the Binance exchange’s profitability.

BNB has gone through 11 burns of coins, and Binance will continue to follow the plan until the total supply is 100 million BNB. Reducing supply, to increase the value of BNB is how Binance benefits BNB holders

-

BUSD & The expanding fiat markets

Binance USD (BUSD) is a new USD-denominated stablecoin approved by the New York State Department of Financial Services (NYDFS) that will be launched in partnership with Paxos and Binance.

The Binance USD was created to be fully collateralized with U.S. dollars held in U.S. bank accounts on a 1:1 basis. These accounts are created and administered by Paxos, and are audited on a monthly basis as prescribed by New York state regulations.

Any requests to buy or sell BUSD are accompanied by a movement of cash into or out of the reserve account. Based on these requests BUSD tokens are either minted or burned accordingly.

In the six months since the launch of BUSD Binance has created several compelling reasons not only to use the stablecoin on the Binance platform, but to also begin using it outside the Binance ecosystem. On the platform itself Binance has expanded trading to include 48 different trading pairs with USD.

This gives investors and traders a chance to trade the token against many of the world’s top cryptocurrencies, as well as against leveraged tokens. Binance has also added a platform that allows for single-click buying and selling with 19 fiat currencies. Investors can do so using USD, EUR, GBP, JPY, RUB, CAD, VND, CNY and more … with bank transfers or with credit cards.

As of early March 2020, market cap of Binance USD nearly $200 million, and daily trading volumes approaching $100 million. Also, there were more than 40,000 users holding BUSD on Binance and Binance.US, with that user base growing by 20-30% on a weekly basis.

BUSD offers several advantages over other stablecoins, such as its improved transparency as a fully regulated stablecoin. It also has price stability, is fully collateralized and audited monthly, has scalability, and is fully supported by the Binance ecosystem, which almost guarantees its continued growth and adoption.

-

Binance Financial – Passive income from investors

There are other methods than trading or investing that can help you increase your cryptocurrency holdings. These can pay ongoing income similar to earning interest, but only require some effort to set up and little or no effort to maintain.

Binance is gradually developing into a perfect bank for investors with a wide range of services to choose from. These include:

- Binance Savings: Binance Lending lets you easily grow your wealth by accruing interest on your funds. Essentially, you’re lending your assets to margin traders on the platform, and they pay interest to you in return for borrowing your funds. You can choose from a wide variety of options, including Bitcoin (BTC), Ethereum (ETH), Binance USD (BUSD), Tether (USDT), and many more.

- Binance Staking: Staking is the process of holding funds in a cryptocurrency wallet to support the operations of a blockchain network. Users are rewarded for simply depositing and holding coins on Binance as they normally would. With staking on Binance, users can receive staking rewards all while just being a regular Binance user. For all users, this means more freedom & accessibility into staking participation for all chains, without giving up full liquidity.

There are currently 23 crypto assets that support Staking on Binance, with an annual interest rate from 1% – 16%

- Binance Loans: Binance Loans platform allows you to borrow USDT or BUSD by securing a collateral amount of crypto within your account. You’re given options regarding how long you want your loan to last (options include seven, 14, 30, and 90 days), as well as the crypto you want to use as collateral (BTC, BCH, XRP, ETH, EOS, or LTC). The platform’s simple interface calculates the collateral and repayment amounts you’ll need to agree to for the loan, as well as the breakdown of how the interest is calculated.

- Binance Pool, a cryptocurrency mining platform dedicated to empowering miners and the global crypto mining industry. By leveraging the benefits of an exchange platform, Binance Pool offers users lower fees and more comprehensive services to increase opportunities and enable miners to earn more. Binance Pool connects miners to Binance’s suite of financial products, including Binance Futures, Spot & Margin trading, Binance Lending, and Binance Staking. Binance Pool will support both PoW (proof-of-work) and PoS (proof-of-stake) mechanisms for mining, made possible by Binance’s technology and computing power. The platform is first launching with a bitcoin mining service, with support for more cryptocurrencies and more customized services to come.